Failure to do so will result in a 0.2% surcharge. Please note: If the amount of residence on second homes or property tax you owe exceeds €300, you must pay directly online or sign up for direct debit on the payment due date or in monthly instalments. Local taxes should not be paid to the Individual Tax Department for Non-Residents (SIPNR). Payment of these taxes, as well as any questions or claims, are managed by the tax office with jurisdiction over where the property is located. Paying local taxesĭuring your time abroad, you will still be liable for local taxes (residence tax on second homes and property tax and, where appropriate, the tax on vacant residential premises) in relation to property that you rent or own. Our sales team contact you and assist you in making well informed decision.Depending on the type of tax you owe (local taxes, income tax, wealth tax), your residence status for tax purposes, and the country in which your bank account is located, you will not be able to use the same methods of payment, nor will you be under the jurisdiction of the same tax department.Įlectronic payment is obligatory if you owe more than €300.

#FLASHCODE CONTACT CODE#

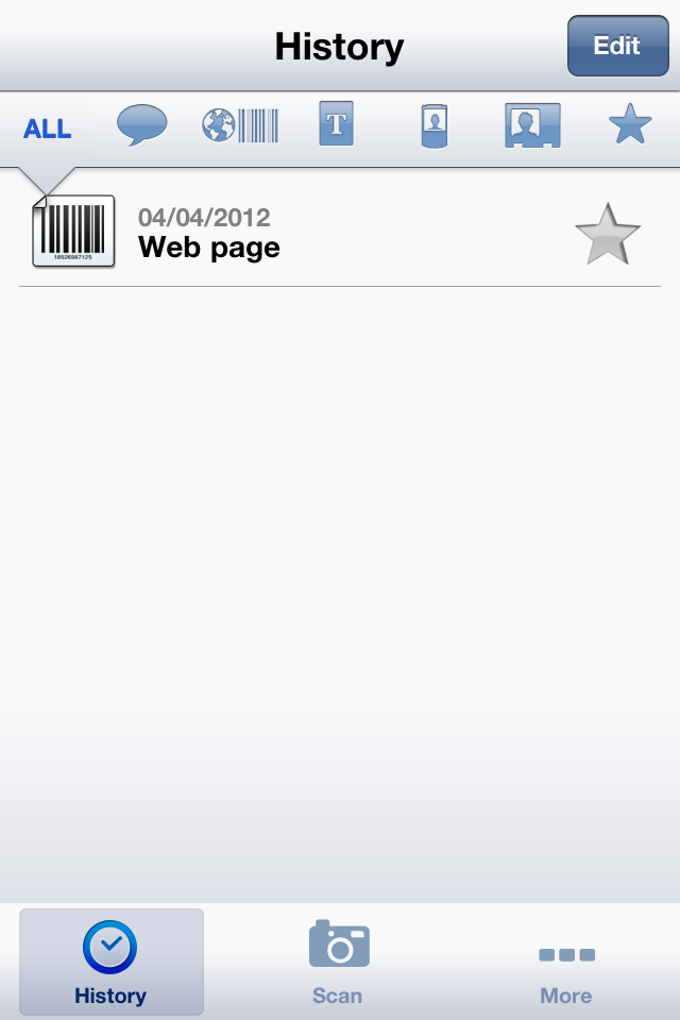

What is the price of Flash Code?įlash Code is available in three different packages, they are:įor more inquiries regarding the software, please request a call. The latest version of Flash Code is Flash Code Q4. What is the latest version of Flash Code available in the market?

#FLASHCODE CONTACT PLUS#

#FLASHCODE CONTACT SOFTWARE#

The medical billing software enables users to create an online infrastructure to support the healthcare organization from scratch.įlash Code provides all the features through these three modules: With a software like Flash Code, the possibility to create something out of the box is limitless. This healthcare software offers a lot of space for users to improve their daily operations and incorporate new features and create modules packed with characteristics necessity for daily operations.

The following goods and services will not be eligible for GST Invoice: Only specific items sold by participating sellers and bearing the callout "GST Invoice Available" on the Platform's product detail page will be qualified for GST Invoice. Please be aware that not every product qualifies for a GST Invoice. The User's specified Entity Name for the User's Registered Business The GSTIN submitted by the User in connection with the registered business of the User. The user will be sent a Tax Invoice ("GST invoice") for the purchase of all such products, which will, among other things, have the following information printed on it: Users are forbidden from using any of the products they buy through the Platform for business, advertising, resale, or further distribution. However, all purchases made on the Platform must be for personal use. Users who have registered businesses can buy products from merchants on the platform that meet their needs.

0 kommentar(er)

0 kommentar(er)